As fun as travelling is, it can incur a lot of unforeseen costs. Thankfully, SafetyWing’s insurance offering is affordable, flexible and easy to use. They are always on hand to answer any questions you may have and submitting a claim is simple. The excess is higher than others, but it does help keep the monthly cost down. Overall, it is a great travel insurance that gives you peace of mind.

I’ve been using SafetyWing for years now and it has provided me with a lot more than just peace of mind! Find out why in my thorough SafetyWing review!

Sign up to SafetyWing today to win a 1-MONTH WORKATION in Mexico City.

The winner will receive a month’s free stay at Selina CoLive in Mexico City. It also includes round-trip flights (up to $2000) and nomad insurance for the duration of the trip. Sign up before 9am PST May 16th 2024 to enter the draw. The winner will be announced shortly after!

Pros

- Affordable insurance

- Flexible subscription

- Use any medical service

- 24/7 assistance

- $0 deductible policy (no claim excess)

Cons

- No coverage for ages 70+

- Claims not always accepted

| Type | Feature | Cost |

|---|---|---|

| Nomad Insurance | Travel & medical | From $56.28pm |

| Nomad Health | Full medical | From $123pm |

Why do you need travel insurance?

There are many reasons why you need travel insurance, whether it is for a week-long holiday or you are a full-time digital nomad (like me!). Here is a summary of these reasons:

- Medical emergencies

- Trip cancellations or interruptions

- Lost or stolen belongings

- Travel delays

- Emergency evacuation

- Adventure activities

- Requirement for visa applications

- Overall peace of mind

Travel insurance is your safety net against unexpected mishaps while on the road. It shields you from exorbitant hospital bills in case of accidents, a scenario more common than you might imagine. Additionally, it steps in to alleviate inconveniences like lost luggage and travel delays.

For instance, during a trip to Vietnam, my partner fell ill, and his travel insurance enabled him to consult a private doctor without worrying about hefty medical expenses. Similarly, when my sister faced a severe kidney infection in Korea, her travel insurance allowed her to receive the necessary hospital care without making her broke.

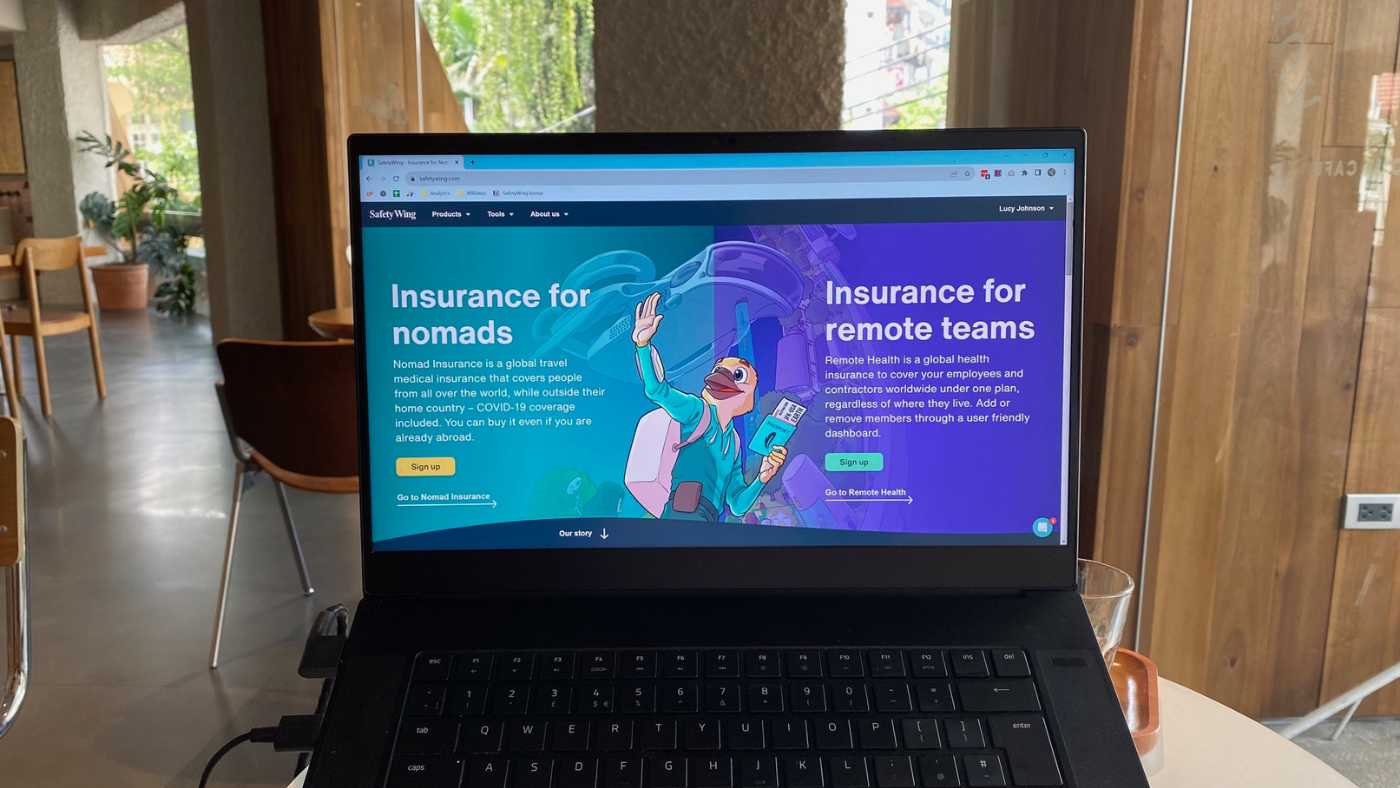

What is SafetyWing?

SafetyWing is a global travel medical insurance designed by and for nomads and travellers. Their core policy offers coverage for unforeseen medical emergencies and travel-related expenses while abroad. Additionally, they have expanded their offerings to include comprehensive global medical insurance and global health insurance for remote businesses.

What are the benefits of using SafetyWing?

In addition to the fundamental advantages of having travel insurance, SafetyWing offers a range of benefits that make it an appealing choice for travellers and nomads alike:

- Affordable policies: SafetyWing provides cost-effective travel insurance options, making it accessible for travellers on various budgets.

- $0 deductible policy (no claim excess): In 2024, SafetyWing removed their $250 claim excess and replaced it with a $0 deductible policy. This means you don’t need to pay to make any claims.

- Medical centre freedom: With SafetyWing, you have the flexibility to choose any medical centre or healthcare provider worldwide, ensuring you receive the care you need when and where you need it.

- 24/7 support: SafetyWing offers round-the-clock customer support, so you can get assistance and guidance at any time, no matter where you are in the world.

- Global coverage: SafetyWing’s policies provide coverage across the globe, allowing you to travel with confidence, knowing you’re protected in various destinations. Moreover, for every 90 days you spend abroad, you get 30 days of cover at home (15 days if you are from the US).

- Nomad-friendly: SafetyWing is designed with the needs of nomads and frequent travellers in mind, offering policies that cater to their unique lifestyles.

- Extensions and flexibility: SafetyWing policies can often be extended while you’re already traveling, providing added flexibility for your trip’s duration.

- Remote work coverage: SafetyWing also offers insurance options for remote businesses, ensuring that you and your team are protected while working from different parts of the world.

Sign up to SafetyWing today to win a 1-MONTH WORKATION in Mexico City.

The winner will receive a month’s free stay at Selina CoLive in Mexico City. It also includes round-trip flights (up to $2000) and nomad insurance for the duration of the trip. Sign up before 9am PST May 16th 2024 to enter the draw. The winner will be announced shortly after!

Who can use SafetyWing?

Pretty much anyone from anywhere in the world can make the most out of SafetyWing. There are however a few exceptions to this based on age and your home country:

- If you were born less than 14 days ago (if this is the case I’m amazed you are reading this), or you are over 70 years old.

- If you are from a sanctioned country (North Korea, Cuba, Iran, and Syria).

For those of you that can use SafetyWing, you don’t need a permanent home residence and you can even add your kids to your policy (1 free child per adult). Children can even take out their own policy if they are somehow travelling solo.

Fun fact: You can take out insurance with SafetyWing even if you are already travelling. This is something that most of their competitors don’t yet offer.

How much does SafetyWing cost?

Prices start from $56.28 per month for their standard Nomad Insurance policy.

This actually makes SafetyWing one of the most reasonably priced and affordable options out there. Some of their competitors are nearly double the price.

Their affordability comes down to the fact that there are no middle insurers involved in the process and their nomad insurance covers just the necessary basics.

If you want a more comprehensive health coverage (for things like maternity coverage and dental) then you can purchase their Nomad Health policy.

As with any insurance policy, the exact price you pay will depend on your age. And when it comes to SafetyWing’s more comprehensive Nomad Health insurance, the price will also depend on the level of coverage you are after. Discover their exact pricing here:

Nomad Insurance policy cost breakdown

There is one Nomad Insurance policy to cover everyone, but the cost depends on your age. Every adult is allowed to add one child between 15 days – 9 years old to their policy for free.

| Age range | 10-39 | 40-49 | 50-59 | 60-69 |

| Price per month | $56.28 | $92.40 | $145.04 | $196.84 |

Please note, there are additional costs for anyone travelling to the US.

Nomad Health policy cost breakdown

The Nomad Health policy features two plans and is priced based on age:

| Policy | 0-17 | 18-39 | 40-49 | 50-59 | 60-74 |

|---|---|---|---|---|---|

| Nomad Health (Standard) | $77pm | $123pm | $184pm | $291pm | $537pm |

| Nomad Health (Premium) | $169pm | $238pm | $391pm | $606pm | $1135pm |

What is covered with Safety Wing?

The coverage depends on which policy you take out. If you are looking for affordable travel insurance that covers emergency expenses related to both health and travel, then take a look below at what is covered in their ‘Nomad Insurance‘ policy. But if you are more interested in a comprehensive global health insurance that covers routine appointments then take a look below at what is covered in their ‘Nomad Health‘ policy.

Nomad Insurance

Nomad Insurance offers protection against unforeseen illnesses or injuries, including coverage for hospital, physician, and prescription drug expenses. In the event of illness or injury, SafetyWing will reimburse eligible medical costs.

This coverage is extended to individuals travelling outside their home country. Furthermore, Nomad Insurance provides emergency travel-related benefits such as evacuation due to local unrest, unexpected overnight accommodations, and compensation for lost checked luggage.

Get more detailed information on what is and isn’t covered on Nomad Insurance here:

What is covered by Nomad Insurance

For medical emergencies:

- Max Limit: $250,000 ($100,000 for WorldTrips policyholders over the age of 65)

- Medically necessary treatment of unexpected illness or injury (inpatient or outpatient): Up to max policy limit

- Ambulance and emergency transportation: Up to max policy limit, when covered illness or injury results in hospitalization

- Emergency transportation to a better equipped hospital (medical evacuation): Up to $100,000 lifetime max, or up to $25,000 in relation to a pre-existing illness or injury

- Emergency dental treatment: Up to $1,000 in relation to acute onset of pain as long as you seek treatment within 24 hours of the pain starting

- All other benefits: Up to the overall max limit

For travel issues:

- An unforeseen event in your home country for which you to need to go home (trip interruption): Up to $5,000

- Unplanned overnight stay: Up to $100 per day for up to 2 days

- Lost checked luggage: Up to $3,000 per active insurance period, $500 per item. Up to $6,000 lifetime max.

- Accommodation in a different place if a natural disaster causes evacuation: Up to $100 a day for up to 5 days

- Evacuation from local political unrest: Up to $10,000 lifetime max

- Personal liability: Up to $25,000 lifetime max for third person injury or property, and up to $2,500 for related third person property.

- Arrangement for your body if you die (burial or repatriation of remains): Up to $20,000 for transportation or up to $10,000 for local burial

- Cash payout to your beneficiary if you die (accidental death): Up to $25,000. Your death has to be the sole and direct result of bodily injury caused by external, violent and visible means.

What isn’t covered by Nomad Insurance

Here is an overview of what isn’t covered by SafetyWing when you use their Nomad Insurance policy:

- Pre-existing illness or injury (except as described in “Emergency treatment of a pre-existing illness or injury”).

- Non-medically necessary treatment.

- Charges exceeding usual, reasonable, and customary.

- Epidemics, pandemics, natural disasters, or disease outbreaks (except as detailed in “COVID-19”).

- Pregnancy, childbirth (except as outlined in “Complications of pregnancy”).

- Mental health disorders.

- Birth defects, congenital illnesses, or hereditary conditions.

- Impotency or sexual dysfunction.

- Sexually transmitted diseases.

- HIV, AIDS, and related diseases.

- Cancer or neoplasms.

- Substance abuse or injuries resulting from it.

- Various skin conditions.

- Sleep apnea or other sleep disorders.

- Obesity and weight modification.

- Self-inflicted illness or injury.

- Suicide or attempted suicide.

- Injuries due to alcohol or drug intoxication.

- Injuries from drunk driving.

- Routine medical examinations.

- Injuries during riots or violent disorder.

- Voluntary use of chemical compounds or poisons.

- Dental treatment (except as described in “Pain relieving emergency dental treatment” and “Emergency dental treatment and surgery following an accident”).

- Organ or tissue transplants.

- Nebulizers, oxygen tanks, diabetic supplies, and similar items (except basic wheelchair or hospital bed if medically necessary).

- Care in establishments for the aged.

- Contraception or conception-related treatments.

- Eye surgery for vision correction.

- Corrective devices (e.g., eyeglasses, hearing aids).

- Hair loss or growth procedures.

- Various therapies and tests.

- Cosmetic or aesthetic treatments (except related to covered surgeries).

- Body modifications for psychological or emotional wellbeing.

- Exercise programs.

- Exposure to non-medical nuclear radiation.

- Cryopreservation, implantation, or re-implantation of living cells.

- Genetic or predictive testing.

- Investigational, experimental, or research-based procedures.

- Treatment not administered by or under a physician’s supervision.

- Services provided by family members or cohabitants.

- Services provided at no cost.

- Missed appointments.

- Coverage under government systems.

- Worker’s compensation or employer’s liability claims.

- Charges related to criminal violations.

- War, military action, or police/military duty.

- Non-covered travel or accommodations.

- Events in the US (except as described in “Medical coverage during visits to your home country” or “[Add-on] Include coverage in the USA”).

- Incidents without an active insurance period.

- Claims made more than 60 days after the insurance period ends.

- Charges for medical or cosmetic treatment travel purposes.

- Complications or consequences of non-covered events.

- Anything not detailed in covered sections of the policy.

Please note, that many of these may be covered by their Nomad Health policy. For example, maternity costs and dental treatment are covered on the premium Nomad Health policy.

Nomad Health

SafetyWing’s Nomad Health Insurance is a comprehensive and versatile health coverage plan designed to meet the needs of modern travellers and digital nomads. This policy goes beyond typical travel insurance, providing extensive medical coverage worldwide, including in your country of residence.

Therefore, it covers a lot more medical expenses than SafetyWing’s Nomad Insurance. This means you can access healthcare for cancer treatments, general health check-ups and a lot more. Plus direct payment from SafetyWing to the medical provider can be arranged.

Get more detailed information on what is covered on Nomad Health here:

What is covered on Nomad Health

The coverage for Nomad Health is comprehensive so I am going to provide a short summary. For a complete overview please click here for the Standard Nomad Health Plan and click here for the Premium Nomad Health Plan.

Standard Nomad Health Plan:

- Worldwide coverage: $1.5M USD

- Outpatient: $5000 USD

- Outpatient co-insurance: 10%

Premium Nomad Health Plan:

- Worldwide coverage: $1.5M USD

- Outpatient: $5000 USD

- Outpatient co-insurance: 0%

- Dental: $1500 USD

- Vision: $500 USD

- Screenings and vaccines: $500 USD

- Maternity: $7500 USD / 20% co-insurance

Sign up to SafetyWing today to win a 1-MONTH WORKATION in Mexico City.

The winner will receive a month’s free stay at Selina CoLive in Mexico City. It also includes round-trip flights (up to $2000) and nomad insurance for the duration of the trip. Sign up before 9am PST May 16th 2024 to enter the draw. The winner will be announced shortly after!

How do you use SafetyWing?

One of the reasons that I really enjoy using SafetyWing is because of how simple it is to set up a policy and manage it. Let me take you through some easy steps on how to use SafetyWing:

Signing up

You will want to start by signing up to a policy on their website. This process is really simple and requires a few details from you about where you’ll be travelling and who your beneficiary is. Use these links to get started:

- Sign up for Nomad Insurance here (from $56.28 per month)

- Sign up for Nomad Health here (from $123 per month)

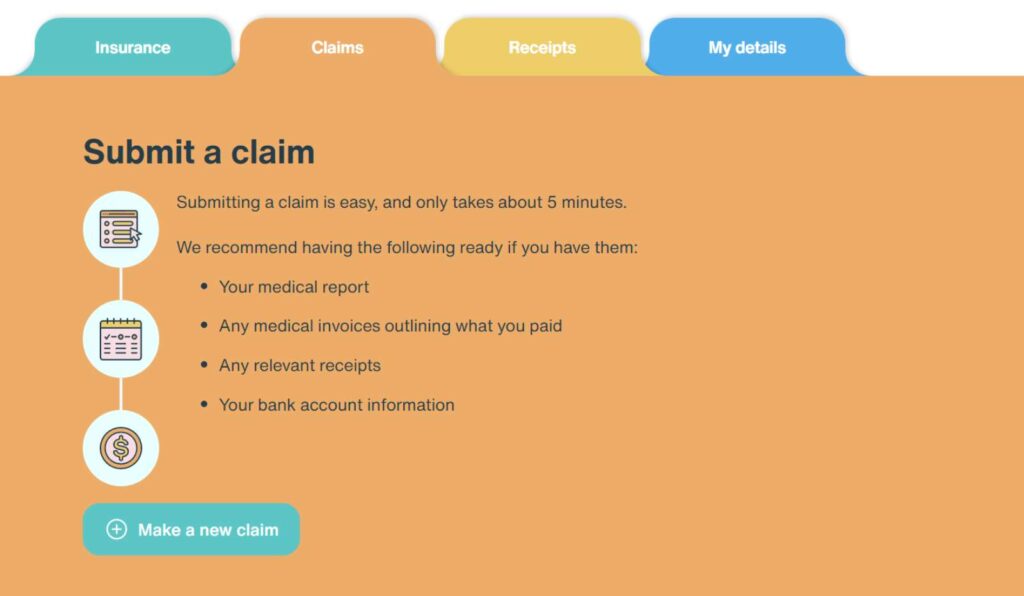

Submitting a claim

In the unfortunate event of something happening to you whilst you are on your travels, you can submit a claim through your SafetyWing account. Simply sign in and click on the ‘Claims’ tab at the top. Here you will be led through an interactive form where you can submit your evidence. You will need to have your medical report, medical invoices, receipts, and bank account information to hand.

Please note: If you are signed up to the Nomad Health policy, SafetyWing can arrange direct payment to your chosen medical provider. Therefore, there will be no need to submit any claims.

Cancelling your policy

Should you need to cancel your policy for whatever reason, you can do this really easily from the ‘Insurance’ tab in your SafetyWing account. The policy will be cancelled before your next billing date, unless you cancel a few days before it is set to renew.

If I am spending a long time (more than 1 month) back at home in the UK I will cancel my insurance during this time. And it is really easy to set up a new policy before I leave the UK again.

Sign up to SafetyWing today to win a 1-MONTH WORKATION in Mexico City.

The winner will receive a month’s free stay at Selina CoLive in Mexico City. It also includes round-trip flights (up to $2000) and nomad insurance for the duration of the trip. Sign up before 9am PST May 16th 2024 to enter the draw. The winner will be announced shortly after!

My verdict: SafetyWing is great for travellers

There was a time when I used to travel without any kind of insurance. Eek. And now I don’t travel without it. I’ve used local insurance companies when I’ve stayed in a specific country for a longer period of time and I’ve also used a few of SafetyWing’s competitors, but my favourite option has always been SafetyWing.

As someone who prioritises flexibility and affordability, it has truly been the best option for me. I like the ongoing monthly subscription which is really easy to cancel.

I know the excess is double that of some competitors, but the ongoing monthly cost is a lot cheaper. And if you are one of the lucky ones not to have something bad happen to you, like me (fingers crossed it stays that way), then you end up saving a lot more money. Moreover, they have removed their claims excess, so there is no fee to make a claim.

I have read concerns from people on the internet that SafetyWing is a scam, but in my own experience, they have been anything but. When a travel partner of mine got ill the process of making a claim was smooth and simple. I have read many other SafetyWing reviews from verified customers that back this up.

For what it is worth, I have been a SafetyWing customer for years before I even decided to write this review!

Overall, I find their insurance gives me much-needed peace of mind. Whenever my suitcase comes at last from baggage reclaim and I’ve been stood there tensely expecting it to have been lost or stolen, I relax the moment I remember that I have my SafetyWing insurance.

Where can you sign up for SafetyWing?

To set up your travel insurance with SafetyWing you will need to go to their website – safetywing.com. From here you can choose your policy and set up your account.

| Type | Feature | Cost |

|---|---|---|

| Nomad Insurance | Travel & medical | From $56.28pm |

| Nomad Health | Full medical | From $123pm |

Sign up to SafetyWing today to win a 1-MONTH WORKATION in Mexico City.

The winner will receive a month’s free stay at Selina CoLive in Mexico City. It also includes round-trip flights (up to $2000) and nomad insurance for the duration of the trip. Sign up before 9am PST May 16th 2024 to enter the draw. The winner will be announced shortly after!

Leave a Reply